Can’t-Miss Takeaways Of Tips About How To Apply For Child Tax Benefit

Apply as soon as possible 5.

How to apply for child tax benefit. If you have a question about the ontario child benefit, contact the canada revenue agency by. The family assistance division administers programs funded by the temporary assistance for needy families (tanf) block grant designed to provide benefits and services to needy families. To be eligible for advance payments of the child tax credit, you (and your spouse, if married filing jointly) must have:

Get the child tax credit. Fill in child benefit claim form ch2 and send it to the child benefit office. The processing time for online child tax benefit applications is also up to eight weeks, so you won't have to wait long for your first payment.

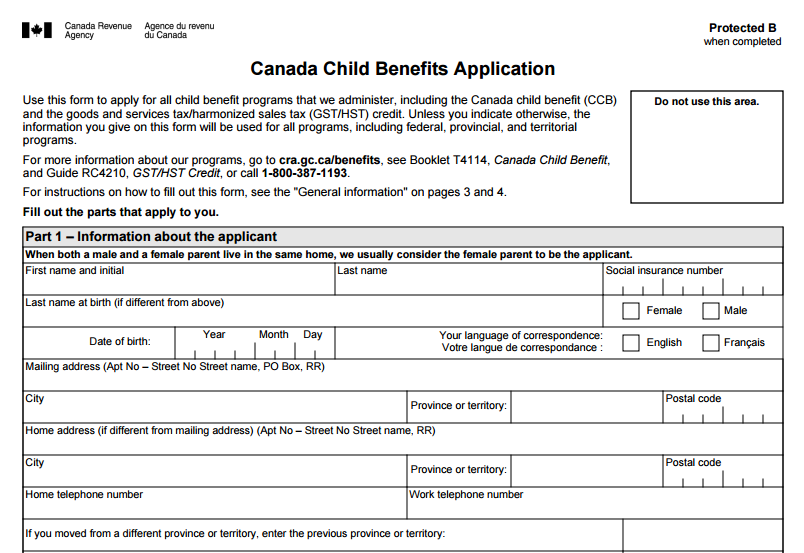

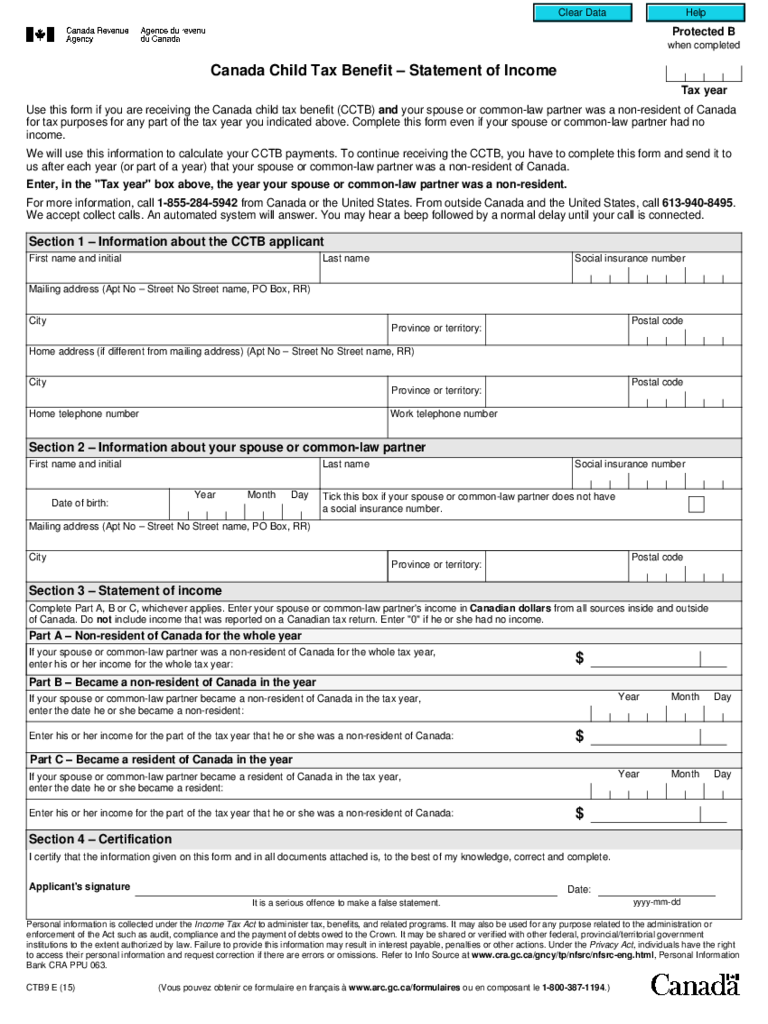

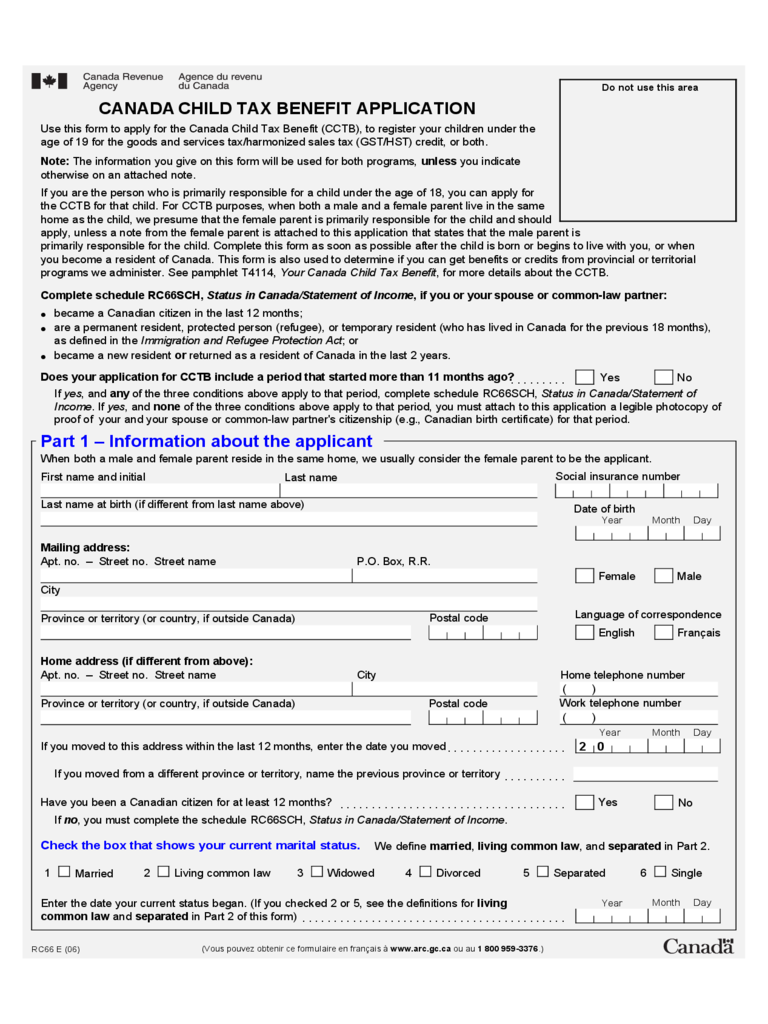

As a resident of new brunswick, you will. However, you must file your taxes using the guidelines posted on the schedule 8812 (form 1040 or 1040a, child tax credit page. Mail to the cra a completed form rc66, canada child benefits application;

No application is needed to use this program. You must file your taxes to qualify for the canada child benefit and the ontario child benefit. If you are already eligible and get full benefits for a child, you may.

You can claim the child tax credit for each qualifying child who has a social security number that is valid for employment in the united states. Use the automated benefits application, if this applies 4. Ad home of the free federal tax return.

Find out if they are eligible to receive the child tax credit. You might be able to apply for pension credit if you and your partner are state pension age or over. The address is on the form.

.png)