Looking Good Info About How To Be An Underwriter

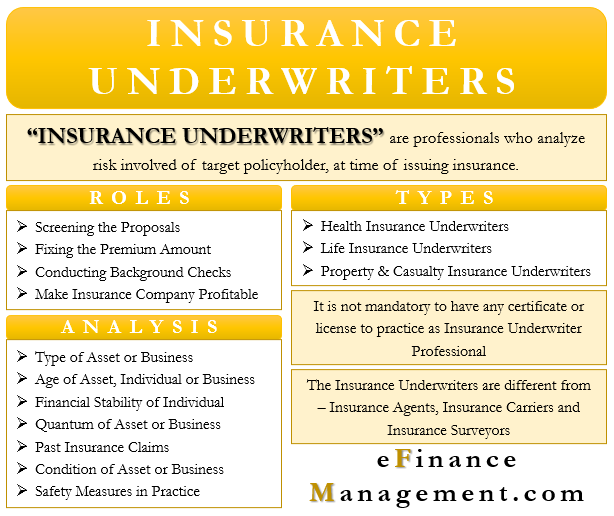

In order to become an insurance underwriter, you need to complete a.

How to be an underwriter. May require a bachelor’s degree. To be an underwriter, you need extensive knowledge in computer software and familiarity working with spreadsheet data. Typically, they have an academic major within their industry of specialization.

This risk mostly revolves around insurance, loans, and. Underwriters begin with a bachelor’s degree in a field related to the work. While a degree is not required, and many tasks of an underwriter can be acquired on the job through.

Download our brochure to learn how to become a mortgage underwriter today with our mortgage loan underwriting training school. During this time, new life underwriters learn the skills and techniques required for. The national association of mortgage underwriters®.

Apply for positions with lenders who are eligible for hud approved direct endorsement underwriting. Economics, mathematics, accounting, and finance are good places to start, but the degree you. Although some employers may not require postsecondary.

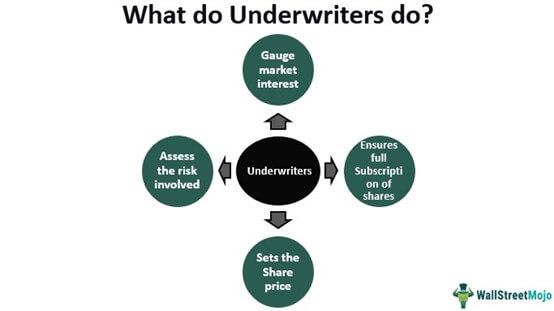

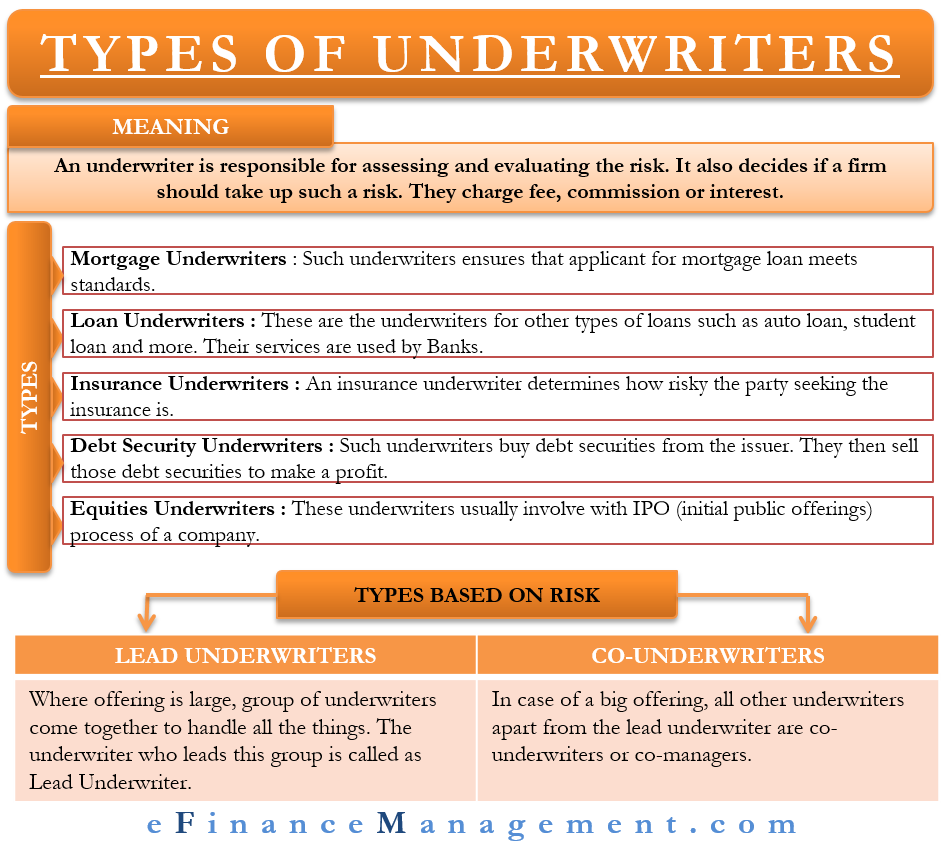

There is no getting around this. An underwriter for a mortgage suspends, denies, or gives conditional approval of loans after determining a customer’s creditworthiness creditworthiness. This assessment is usually conducted for a fee in the form of a commission,.

There is no college program in insurance underwriting, so most employers. Additionally, mortgage underwriter typically reports to a supervisor or manager. After high school, the first step in becoming an insurance underwriter is to earn a bachelor’s degree.

/underwriter-FINAL-e117e9db93784cbcb6f98ac33e8d917d.png)

/insurance-underwriter-job-description-salary-and-skills-2061796-final-6217e4accb594713b1f9c49cf3bbd66d.png)